hotel tax calculator quebec

Calculate your take home pay in 2022 thats your 2022 salary after tax with the Canada Salary Calculator. Remember that how much tax you will pay on your salary in Quebec is a.

Statistics Canada Property Taxes

Afin deffectuer un calcul mental simple de la TPS et TVQ vous pouvez utiliser cette méthode.

. You can also explore Canadian federal tax brackets provincial tax. If you make 52000 a year living in the region of Quebec Canada you will be taxed 15237. Do you like Calcul Conversion.

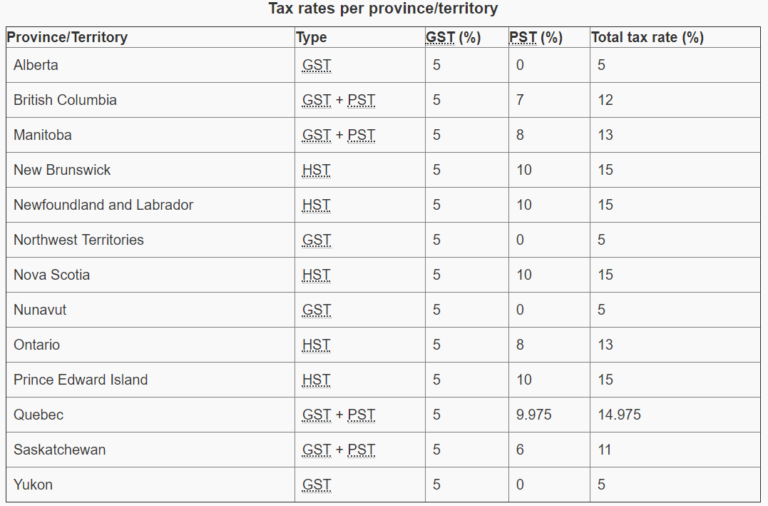

The cumulative sales tax rate for 2022 in Quebec Canada is 14975. CWB 2022 rates are using 2021 rates indexed for inflation. Quebec Sales Tax Calculator.

Avalara automates lodging sales and use tax compliance for your hospitality business. Amount before sales tax GST 5 QST 9975 Amount with sales tax. The accommodation unit is acquired by an intermediary a person.

However it is 350 per overnight stay when. That means that your net pay will be 36763 per year or 3064 per month. Add this amount to 1260.

The most popular tool to calculate taxes in. The tax on lodging is usually 35 of the price of an overnight stay. This total rate is a combination of a Goods and Services Tax GST of 5 and a Quebec Sales Tax QST of.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. The total amount you will pay for a 12 CAD item is 1367. The answer is 107.

Multiply 1260 by 85 percent 085. Tax in Quebec is determined by the taxable income amount. Use our free 2021 Quebec income tax calculator to see how much you will pay in taxes.

The Tax Shield is not included in the calculation. Calcul taxes TPS et TVQ au Québec. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at.

Ad Finding hotel tax by state then manually filing is time consuming. The Quebec Income Tax Salary Calculator is updated 202223 tax year. In 2021 Quebec provincial income tax brackets and provincial base amount was increased by 1.

Avalara automates lodging sales and use tax compliance for your hospitality business. Le TIP est au moins égal à. 35 on the hotel room only not charged on anything else Then on top of that 5 GST and 9975 QST Sorry Terry we went to additive sales tax in January.

Calculators Quebec income tax planning calculator Quebec Income Tax and RRSP Savings Calculator for 2022 2021 and Prior Years. Basically 18999125 on hotel rooms. Quebec provincial income tax rates 2021.

So it would be 100 - 10350 then. Calculez vos taxes TPS et TVQ dès maintenant. This is any monetary amount.

Quebec Income Tax Rates. To avoid such a situation know the GST is calculated at the rate of 7 on the sale price and the QST is calculated at the rate of 75 at the price already including the GST. The following table provides the GST and HST provincial rates since July 1 2010.

Quebec Income Tax Calculator. The detailed Quebec Income Tax Calculator for. Calculate sales taxes for residents of Quebec 2022.

45105 or less is taxed at 15 more than 45105 but not more than 90200 is taxed at 20 more than 90200 but not more. The rate you will charge depends on different factors see. Attention certains barsrestaurants font payer le pourboire sur le montant TTC alors quil devrait être calculé sur le montant HT.

2021 Quebec Income Tax Calculator. This means the total tax on the item is 167. Ad Finding hotel tax by state then manually filing is time consuming.

Quebec income tax rates are staying the same for 2021 but the levels of each tax bracket will be increasing. Calcul Taxes Québec est loutil de calcul de taxes TPS et TVQ le plus utilisé au Québec. Actual 2022 CWB rates may not be known until Dec 2022 or Jan.

Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for. Income Tax Calculator Quebec 2021. 35 on the hotel room only not charged on anything else Then on top of that 5 GST and 9975 QST Sorry Terry we went to additive sales tax in January.

This tool will calculate both your take-home pay and income taxes paid per year month two-week pay period and day. So it would be 100 - 10350 then. Type of supply learn about what.

Quebec is one of the provinces in Canada that charges separate provincial and federal sales taxes. Basic personal amount in Quebec for year 2021. En utilisant le montant avant taxes déplacez la virgule ou le point dun chiffre vers la gauche.

Quebec Sales Tax Calculator And Details 2022 Investomatica

Statistics Canada Property Taxes

Canadian Tax Return Tax Calculator For Canada Moving2canada

Payroll Tax Q Series Robust Tax Engine Vertex Inc

Best Tax Return Softwares In Canada 2022 Greedyrates Ca

Don 039 T Forget These Tax Deductions For Your Airbnb Or Other Short Term Rental

Updated For 2022 Your Guide To Taxes In Toronto Canada

Statistics Canada Property Taxes

Sales Tax Updates Covid 19 Taxconnex

Sales Tax Updates Covid 19 Taxconnex

How To Calculate Canadian Sales Tax Gst Hst Pst Qst Impac Solutions

How Does A Salary In Canada Compare To One In The United States For Example Let S Say You Re Offered 100 000 Canadian Dollars What Would Be The Comparable Income In The U S Considering

Moving Expenses And Tax Deduction Move It

Littoral Hotel Spa Quebec Qc 3710 Ste Anne G1e3m3

Quebec Sales Tax Calculator And Details 2022 Investomatica

Calculate Import Duties Taxes To Canada Easyship